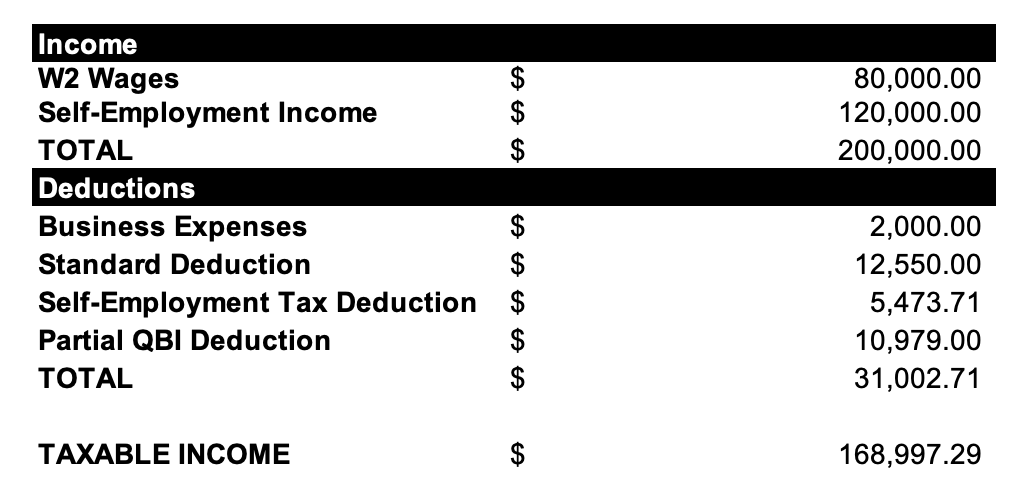

Calculate self employment tax deduction

Use the IRSs Form 1040-ES as a worksheet to determine your. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports.

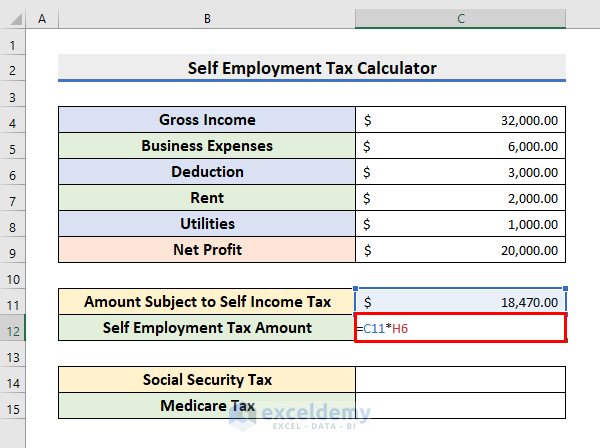

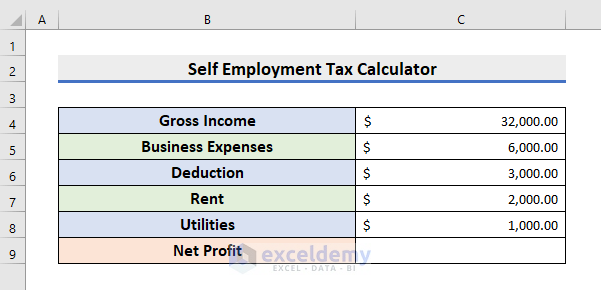

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

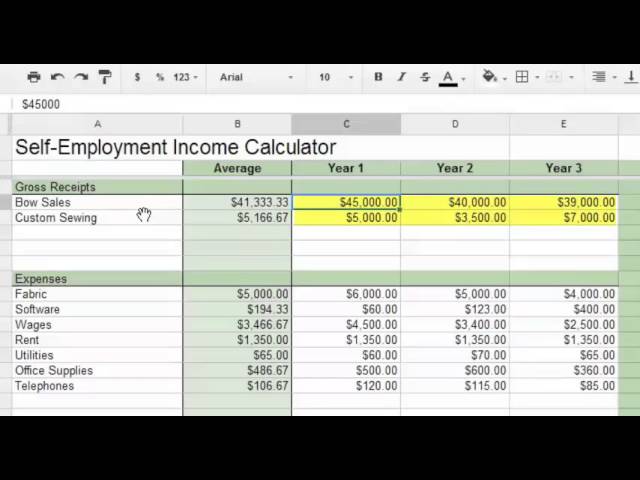

This is calculated by taking your total net farm income or loss and net business income or loss.

. Calculating your self-employment tax involves several steps. Normally these taxes are withheld by your employer. 29 on all of your earnings.

Ad We have the experience and knowledge to help you with whatever questions you have. Net earnings are usually your gross income. Use this calculator to estimate your self-employment taxes.

This is your total income subject to self-employment taxes. What Gig Workers Need to Know About Filing Yearly Quaterly Taxes. Best Average Rating For Customer Support.

Try Our Free Tax Refund Calculator Today. Helping You Avoid Confusion This Tax Season. However if you are self-employed operate a farm or are a church employee.

Your self-employment tax total is calculated according to your net income including wages and tips. According to NerdWallet the process of calculating self-employment tax begins with calculating your annual net earnings from self-employment. You cant simply multiply your net profit on Schedule C by.

Determine your net earnings. The Schedule C IRS form lists a bunch of expenses you can deduct from your income if youre self-employed. Our clients typically receive refunds 7061 greater than the national average.

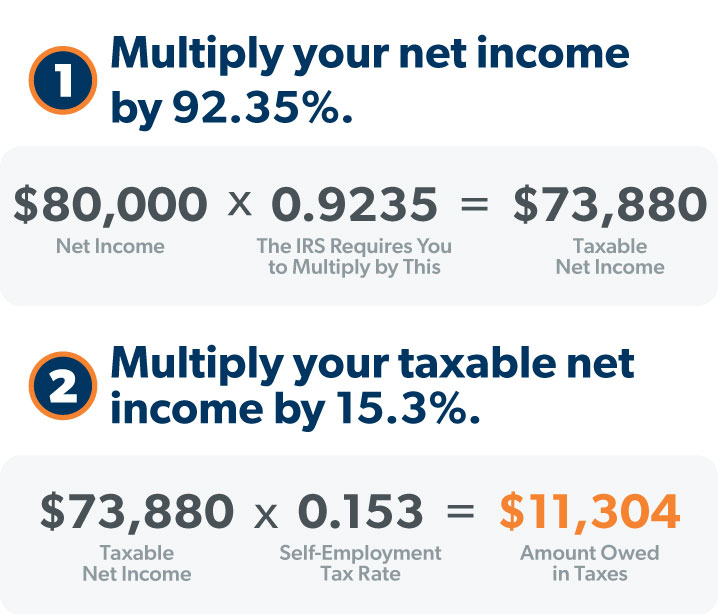

Import Your Tax Forms And File With Confidence. You calculate your self-employment tax on Schedule SE and report that amount in the Other Taxes section of Form 1040. The tax rate is calculated on 9235 of your total self-employment income.

That rate is the sum of a 124 Social Security tax and a 29 Medicare tax on. 153 maximum If you are self. Ad Time To Finish Up Your Taxes.

Here is how to calculate your quarterly taxes. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. The self-employment tax rate for 2021-2022 As noted the self-employment tax rate is 153 of net earnings.

Calculate your adjusted gross income from self-employment for the year. Add all net profit from your self-employment activities Multiply this amount by 09235 to account for the self. In this way the IRS differentiates the SE tax from.

Taxes Paid Filed - 100 Guarantee. Subtract your business expenses and deductions from your gross income. Ad Find Tips to Help You Figure Out Valuable Deductions and the Self-Employment Tax.

How to Calculate Self-Employment Tax. Ad We have the experience and knowledge to help you with whatever questions you have. Super Easy To Get Up and Running.

Ad Easy To Run Payroll Get Set Up Running in Minutes. Tax Deductions for Self-Employment. Here are the steps to calculate this figure.

Our clients typically receive refunds 7061 greater than the national average. This formula works to determine employees allocations but your own contributions are more complicated. If that number is higher than.

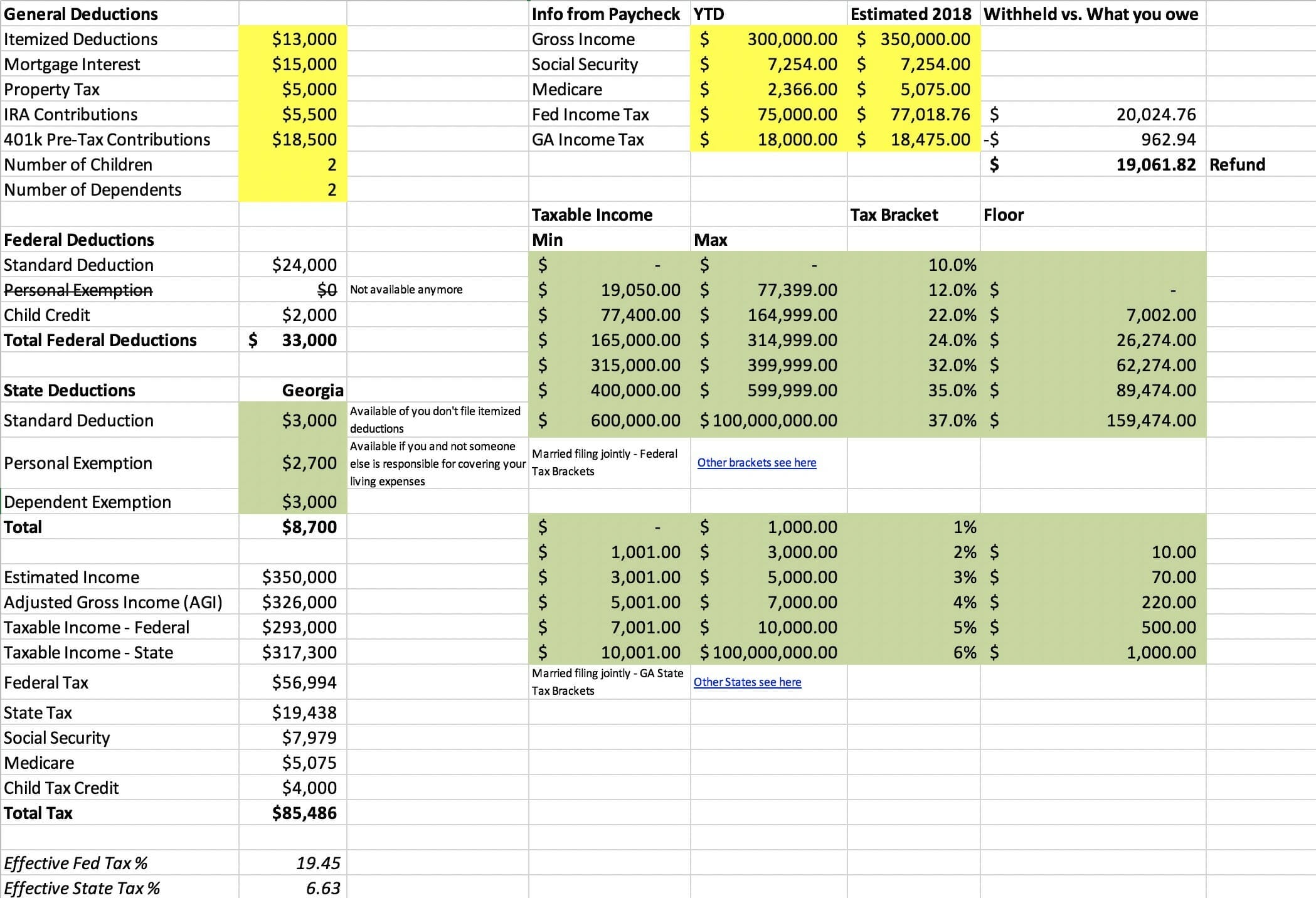

Per the latest tax rates available on the IRS website the self employed tax rate for 2017 will be as follows.

Self Employment Calculator Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Self Employment Calculator Youtube

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

14 Tax Tips For The Self Employed Taxact Blog

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

Free Expenses Spreadsheet For Self Employed

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Freelance Taxes In Canada 9 Things You Need To Know 2022 Turbotax Canada Tips

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Schedule C Income Mortgagemark Com

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos